Retention 101

no inglés? no problem. versión en español here.

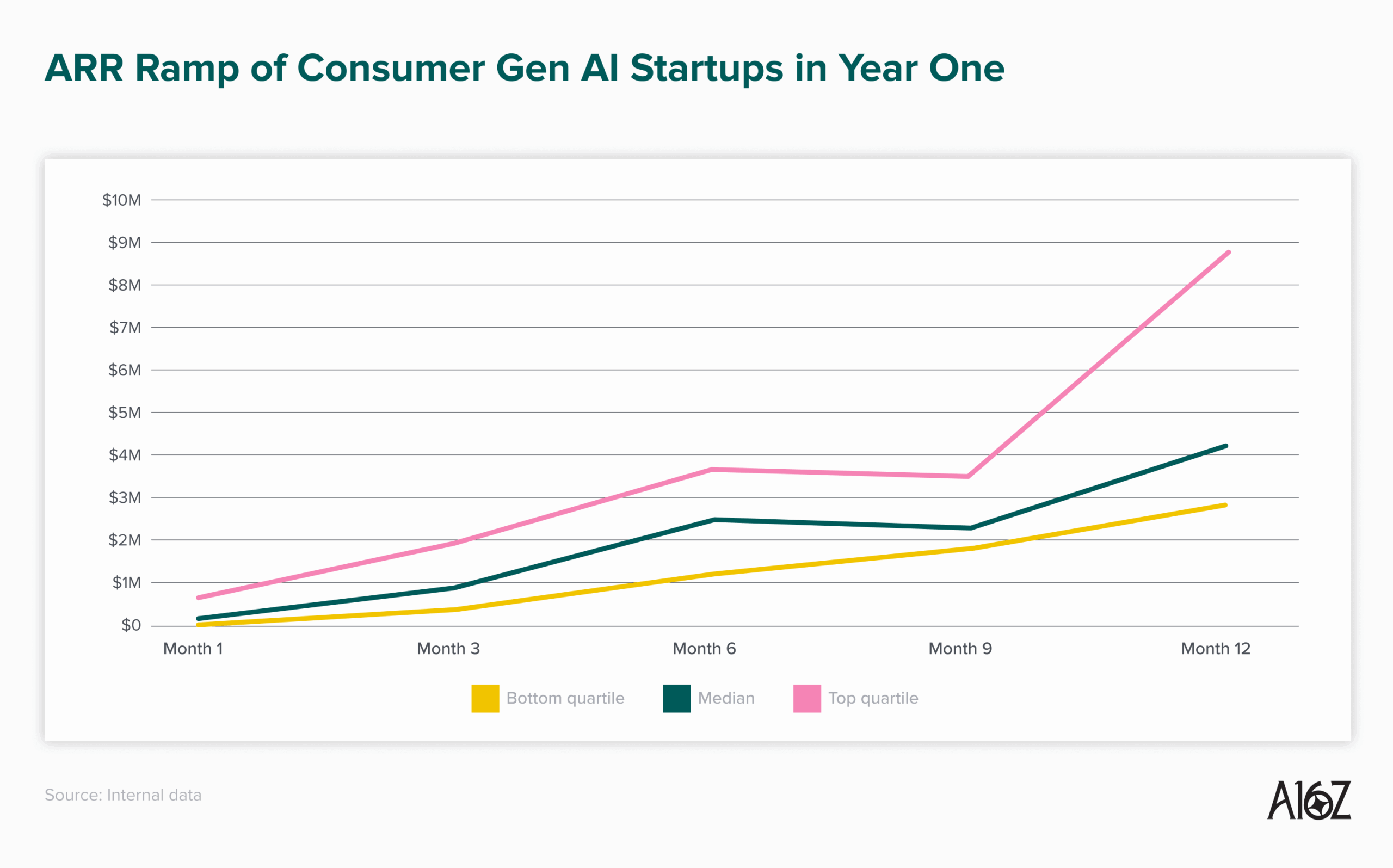

Doomscrolling Linkedin and startup Twitter (yes Twitter I’m that old I guess) is the new dopamine craving for many founders I know. These two are an infinite eco chamber of growth hockey sticks in user growth, see self-reported millions of ARR in 0.72 hours after launching, and founder selfies in time square with #buildinginpublic. I was reading the a16z data dump on revenue growth, and immediately thought of the ZIRP era (Zero Interest Rate Policy), didn’t we all learn from it that the most important thing is retention? Consumer AI companies are generating revenue, coolio. But how sticky is it really?

Meanwhile my local bodega’s owner who’s never heard of CAC, I’m sure retains 98% of her customers and has returning users since the Bush administration. Lupita, the owner doesn’t use Mixpanel and couldn’t care less about LTV. But what she knows is that everyday at 12pm she must have her Coca-cola fridge full of freezing soda cans for blue collar workers changing shifts. Thats clear share holder value creation. That is power.

Startups are gravity-defying triple mortal backflips. Retention is gravity.

People don’t seem to understand that retention IS growth. Hockey stick growth looks good until the ghost of churn comes and bites your butt. Darlings of 2021 all had beautiful up and to the right curves until someone dared to ask about Net Dollar Retention. Then suddenly: layoffs, quiet wind downs and rebrands on LinkedIn.

Sequoia is top tier because they understand retention so deep that wrote this on stone:

Engagement → Stickiness → Retention → Growth.

Growth is a consequence of engagement, and I know you are not measuring it right.

Net dollar retention is the ring (metric) to rule them all. It doesn’t forgive, doesn’t care about 30 U 30, it sees through your eyes and audits your soul. If it’s >=100% you are compounding, if it’s <100% you’re bleeding. Experienced investors know that high NDR signals product-market-fit, capital efficiency, and future probability all at once.

Acquisition subsidies will kill your startup. Easy becomes addictive, addictive becomes fatal. Meanwhile Lupita’s bodega is stacking up receipts.

Let’s talk money — real money, not your guessed TAM slide. Bain & CO demonstrated that a 5% lift in retention can juice profit from 25% to 95%. Meanwhile CAC increase is eating your margins alive. Customer success, that’s part of customer acquisition cost too, hope you are measuring it right.

Small businesses default to retention because they need it to survive. Venture backed circuses — You and me? We default to raise another round to outrun reality. Startups are paying top dollar to build a leaky funnel while Lupita keeps her margins tight and her fridge stocked with *loyalty*.

Here’s a dirty little secret: I have weekly meetings with pre-series A and Series A companies who can define CAC and LTV from memory, yet they can’t quote their D1-D7 and M1-M6 retention. Intitialized Capital’s benchmark list for raising series A doesn’t even bother explaining retention — it’s expected from you to know. The dirty little secret? That assumption is wrong.

If you don’t understand your: Engagement → Stickiness → Retention → Growth. You’re not a CEO, you’re a motivational speaker with a Stripe Account. Let’s. Not even talk about my favorite metric: adherence. But you’re not ready for that yet. And no you will not find it anywhere, I invented it.

This Echo-chamber is a Ponzi scheme for attention.

Attention has become a social currency and gravitates towards spectacle, not substance. The Wall Street Journal recently profiled SaaS high-flyers sprinting to $500 million ARR only to confront brutal cash-burn reckonings. So you, dear founder, subconsciously optimize for applause instead of durability. Congratulations, you’ve been growth-hacked by your own ego. Some will IPO, others will crash, but the survivors share one trait: militant customer loyalty. Brand-loyal consumers repurchase irrespective of price, driving higher share-holder returns. That’s not romance; it’s arithmetic.

Let’s circle back to my corner grocery store. It never raised a round. Never sent a cold email to Sequoia. Yet its retention sits 98% across multiyear cohort, because everyday people go there to buy the coldest canned soda from the neighborhood. The most important asset: Lupita, she knows my name, my order, my dog’s name, gives me credit when I don’t carry cash (yes, cash is still a thing in Mexico). She never spent acquisition, but extracts lifetime value until the day someone changes zip code. You and I bring cash to accomplish the digital equivalent — you’re failing.

Embarrased? Good. Guilt is the first symptom of awakening.

Come , sit next to me.

THIS IS AN INTERVENTION.

Tomorrow morning pull last quarter’s customer list. Highlight anyone who paid you in January but ghosted by April. Sum their lost ARR. Now open your bank statement and tally ad spend for the same period. If the lost ARR eclipses the dollars you torched on Facebook, you are literally paying to dig your own grave. You don’t need a growth hacker; you need an exorcist.

Brian Balfour notes that retention IS growth because it amplifies every subsequent acquisition loop. But he also warns that low-retention models can work when marginal cost goes to zero. Newsflash: unless you’re open-sourcing magic, your marginal cost isn’t zero, and investor patience definitely isn’t.

Cognitive dissonance is laced into founder DNA. We value optimism, we crave motion, we worship hockey-stick curves. Retention feels like maintenance, and maintenance is boring. Yet founders who ignore gravity eventually emulate Icarus—waxed wings, sudden plunge. My enemy is churn, and I intend to bury it—on your behalf if you let me, over your cap table if you don’t.

Here’s my offer: spend the next four weeks with me. I will make you hate churn the way a surgeon hates gangrene. By week four you’ll measure NDR before you check runway. You’ll flaunt cohort charts on first dates. And if you still cling to vanity metrics, I’ll print this article, fold it into a paper airplane, and let gravity finish the lesson.

Fellow founder: Retention is your enemy, your enemy is my enemy. Let me help you.

Now close this tab, open your retention dashboard—assuming you have one—and start counting the bodies. When the number hurts, email me. Confession is the first step in rebuilding a soul, and a company.

Was this post useful? Subscribe. Need help? emails are open :) [email protected]